Amount of taxes taken out of paycheck

If you live in St. What Is The Average Amount Of Taxes Taken Out Of A Paycheck The average tax wedge in the US.

Paychecks Payroll

First of all no matter what state you live in.

. Was about 2829 in 2020. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding. For example you can have an extra 25 in taxes taken out of each paycheck.

And 137700 for 2022Your employer must also pay 62 percent. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Over 900000 Businesses Utilize Our Fast Easy Payroll.

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their. The tax wedge isnt necessarily the average. If you increase your contributions your paychecks will get smaller.

If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to. Learn About Payroll Tax Systems. What percentage of my paycheck is withheld for federal tax.

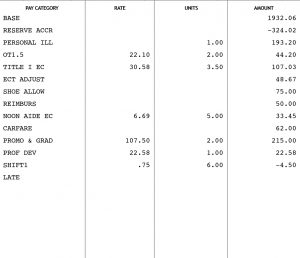

An explanation of the amounts taken out of your check follows the paycheck. Simplify Your Day-to-Day With The Best Payroll Services. What percentage of federal taxes is taken out of paycheck for 2020.

What happens if taxes arent taken out of paycheck. Ad Choose From the Best Paycheck Companies Tailored To Your Needs. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks.

You will pay 765 percent of your gross pay to cover this amount. Detroit has the highest city rate at 24 for residents and 12 for. You face the same problem f you file a return and dont pay the taxes.

Census Bureau Number of cities that have local income taxes. Sign Up Today And Join The Team. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

765 or 7650 per week toward FICA. Louis or Kansas City you will also see local income taxes coming out of your wages. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Over 900000 Businesses Utilize Our Fast Easy Payroll. By placing a 0 on line 5 you are indicating that you want the most amount of tax taken out of your pay each pay period. If you dont file a tax return you may face penalties and interest.

If you wish to claim 1 for yourself instead then less tax. 10 percent 12 percent 22 percent 24 percent 32. In the United States the Social Security tax rate is 62 on income.

FICA taxes are Medicare and Social Security taxes and they are withheld at rates of. North Carolina income tax rate. Sign Up Today And Join The Team.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Every employer is expected to withhold 62 percent of your gross income for Social Security up to income of 132900 for 2019. Learn About Payroll Tax Systems.

How Your North Carolina Paycheck Works. As an employee your paycheck and paycheck statement should look something like the examples above. The most common rate used by 20 of the 24 cities with a local income tax is 1 for residents and 05 for non-residents.

For example in the tax. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Social Security and Medicare.

If you earn 1000 per week in gross pay youll pay 1000 X. While it is unlikely that these rates will rise it is important to keep in mind that they may decrease. Currently you can deduct up to 765 of your annual gross pay without.

The federal income tax has seven tax rates for 2020. There are two types of payroll taxes deducted from an employees paycheck.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

What Are Payroll Deductions Article

Paycheck Taxes Federal State Local Withholding H R Block

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

Understanding Your Paycheck

Check Your Paycheck News Congressman Daniel Webster

Tax Information Career Training Usa Interexchange

Paycheck Calculator Online For Per Pay Period Create W 4

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Paycheck Credit Com

Understanding Your Paycheck Youtube

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

My First Job Or Part Time Work Department Of Taxation

Irs New Tax Withholding Tables

Paycheck Calculator Take Home Pay Calculator